About us

Mission

To efficiently collect tax revenues in support of State services and programs while acting with integrity and fairness in the administration of the tax laws of New York State.

Overview

The New York State Department of Taxation and Finance collects tax revenues that fund services and programs that benefit New Yorkers. In fiscal year 2024, we collected more than $147 billion in state and local taxes.

Our department administers 49 state and local taxes and fees, including $23 billion in local sales tax and more than $14 billion in local income tax. In regard to real property taxes, the department supports more than 1,000 local governments that, in 2024, administered more than $71 billion in local property taxes. To explore, search, download, and share data about the taxes we administer, see Tax data.

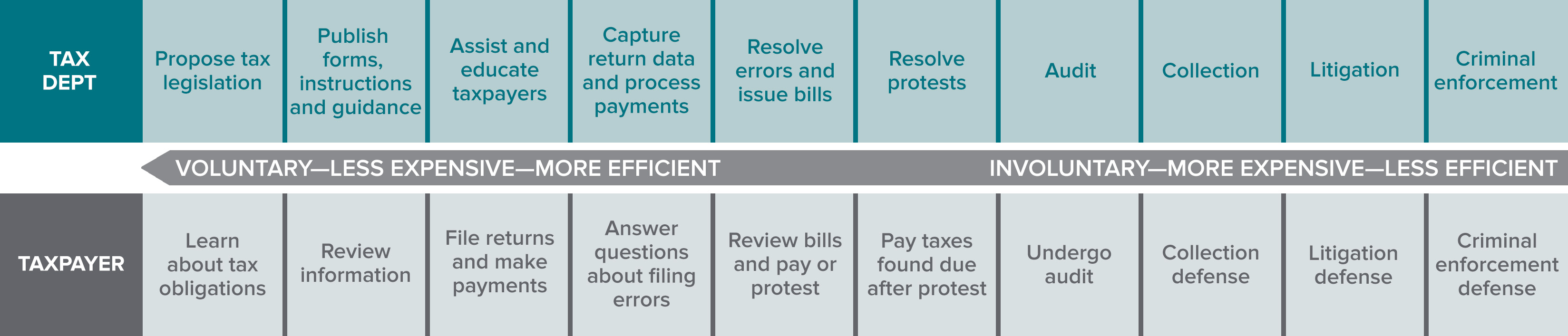

A key department focus is the balance of efforts to promote voluntary compliance—the cornerstone of the State's system of taxation—with the duty to enforce New York's tax laws. More than 96 percent of the taxes collected are remitted voluntarily by taxpayers. The remaining 4 percent is a result of the department's enforcement programs—audit, collections, and criminal investigations.

Voluntary–less expensive–more efficient. Involuntary–more expensive–less efficient.

- Tax department

- Personal tax legislation

- Publish forms, instructions and guidance

- Assist and educate taxpayers

- Capture return data and process payments

- Resolve errors and issue bills

- Resolve protests

- Audit

- Collection

- Litigation

- Criminal enforcement

- Taxpayer

- Learn about tax obligations

- Review information

- File returns and make payments

- Answer questions about filing errors

- Review bills and pay or protest

- Pay taxes found due after protest

- Undergo audit

- Collection defense

- Litigation defense

- Criminal enforcement defense

Other responsibilities

The department is also responsible for the administration of the State's treasury. The Division of the Treasury receives and disburses State funds, and serves as a custodian of special funds. The division is also a joint custodian of State securities with the State Comptroller.

Through agreements with other State agencies, the department collects additional revenues on behalf of individuals and the State, as well as assisting with fraud detection. Examples of joint measures include enforcing the collection of delinquent child support payments and identifying fraud regarding public assistance and unemployment insurance benefits.

Learn about the Tax Department

Leadership team

The leadership team at the Department of Taxation and Finance works with the governor and the executive branch to oversee New York’s revenue system.

Employment opportunities

Department employees are dedicated to public service and have many opportunities for personal and professional growth.

Procurement opportunities

The department provides information on current and archived bid opportunities, as well as submission guidelines, disclosure requirements, and procurement lobbying requirements.

Regulations and regulatory actions

The official compilation of the Department of Taxation and Finance regulations is contained in Title 20 of the Codes, Rules and Regulations of the State of New York (20 NYCRR). For a summary of the department’s rule making actions from 2001 to present, proposals and adoptions by tax type, and more, see our webpage.

Division of Treasury

The Division of Treasury is joint custodian of the state's general checking account with the Office of the State Comptroller, managing over $300 billion in annual transactions.

Project Sunlight

Project Sunlight is an online database that provides New Yorkers with information about individuals and entities who interact with New York State government decision-makers.

Awards

The department has won more than 25 awards since 2011, including Public Service Excellence awards for both teams and individuals at the department.

Transparency plan

The Tax Department is committed to engaging with taxpayers in ways that improve the taxpayer experience and enhance public access to tax guidance and other resources.

For self-help options and phone numbers, see Contact us.