Check your refund status online—anytime, anywhere!

To check your refund status, you need the amount of the New York State refund you requested. See Requested refund amount to learn where to find this amount.

Note: You cannot use Check Your Refund Status to view the status of a payment. To confirm your payment was received, check with your financial institution.

To check the status of an amended return, call us at 518-457-5149.

Para español, llámenos al 518-457-5149—oprima el dos.

Understand your refund status

When you submit your tax return, it will go through several steps of processing. Each return is different. A simple return will process faster, but returns requesting certain credits that are an attractive target for fraud will likely require additional review by one or more department-review systems.

See Understanding your refund status to learn about the refund status message you received.

When your refund status changes, the message will automatically update in our automated phone system, our online Check Your Refund Status tool, and the account information available to our Call Center representatives.

Locate your requested refund amount

When you use Check Your Refund Status, you'll enter information we use to verify your identity. Locate the refund amount you requested on your tax return using the chart below.

| If you filed | for tax year | your requested refund amount is |

|---|---|---|

| Form IT-201 | 2020-2025 | on Line 78. |

| Form IT-203 | 2020-2025 | on Line 68. |

| Form IT-205 | 2020-2025 | on Line 39. |

| Form IT-214 | 2020-2024 2025 |

on Line 33. on Line 20. |

| Form NYC-208 | 2019 | on Line 29. |

If you don't have a copy of your return, see I don't have a copy of my tax return. What do I do? for instructions.

If the line on your return where you request a refund amount is blank or you entered zero, you have not requested a refund and cannot use our Check Your Refund Status tool. You cannot use Check Your Refund Status to view the status of a payment.

If you enter information that doesn't match our system, you'll receive an error message. After four attempts, you won't be able to access your status for 24 hours. To resolve your issue, review the Social Security number and refund amount you entered to confirm they're correct. Our representatives cannot provide your requested refund amount, even after verifying your identity.

Get answers to common refund questions

We receive millions of calls each year from taxpayers requesting more information about their refund statuses.

And every year we look for better ways to give you the information you need without requiring you to stay on hold to ask a representative. We developed this resource to help answer some of your most common questions.

Find what you're looking for

Looking for one of these?

- Respond to a bill or notice online

- Did you receive mail from us?

- Subscribe to Tax Tips for Individuals

- Individuals home

If these aren't right, try searching our website.

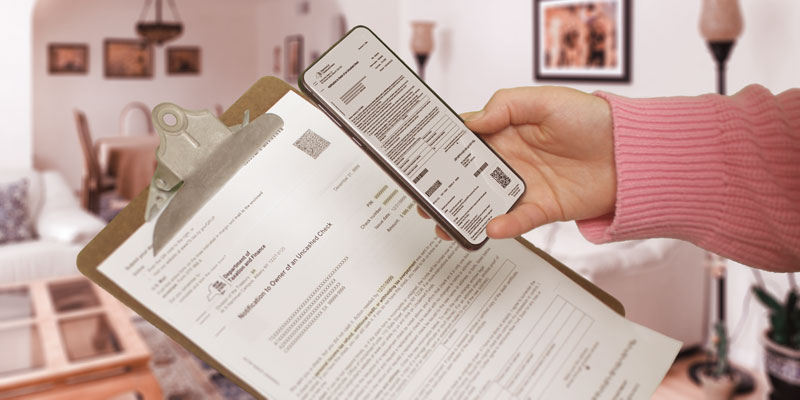

Scan snap submit ad

Scan, snap, submit!

Did you receive a letter asking you to complete Form DTF-32, DTF-33, DTF-36, TD-210.2, TD-210.3, or TD-210.7?

To receive your new check sooner, use your mobile device to submit your form online!

- Scan the QR code on your letter.

- Snap a photo of your completed form.

- Submit your photo.

Benefits include:

- security, without the hassle of an account

- no printer or computer required

- instant confirmation we received your form