Sales and other transaction taxes

Sales tax and other transaction tax

New York State administers a sales tax along with numerous other transaction taxes. Collections of sales and other transaction taxes increased by $0.5 billion to $21 billion in 2024.

| Calendar year | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|---|

| User taxes and fees | $15,611 | $16,266 | $16,865 | $15,462 | $17,890 | $19,159 | $20,481 | $20,984 |

| Sales and use | $13,485 | $14,119 | $14,799 | $13,450 | $15,867 | $17,490 | $18,574 | $19,000 |

| Motor fuel | $514 | $525 | $519 | $445 | $477 | $194 | $473 | $487 |

| Cigarette and tobacco products | $1,183 | $1,128 | $1,051 | $1,018 | $976 | $881 | $832 | $818 |

| Vapor products | NA | NA | $2 | $38 | $33 | $29 | $25 | $21 |

| Adult-use cannabis | NA | NA | NA | NA | NA | NA | $25 | $124 |

| Medical cannabis | $1 | $3 | $6 | $8 | $12 | $12 | $9 | $5 |

| Opioid tax | NA | NA | NA | $42 | $27 | $29 | $24 | $20 |

| Alcoholic beverage tax | $260 | $261 | $263 | $268 | $277 | $279 | $276 | $271 |

| Highway and fuel use | $92 | $147 | $141 | $134 | $144 | $131 | $143 | $137 |

| Auto rental tax | $76 | $83 | $84 | $59 | $78 | $92 | $95 | $101 |

| Tax registration type | Active taxpayers |

|---|---|

| Sales tax Certificate of Authority | 562,889 |

| Cigarette tax Certificate of Registration (only)—retailer | 4,863 |

| Vapor tax Certificate of Registration (only)—retailer (began November 2019) | 351 |

| Cigarette or tobacco and vapor taxes Certificate of Registration (both)—retailer | 7,044 |

| Adult-use cannabis Certificate of Registration—distributor (began July 2022) | 158 |

| Adult-use cannabis Certificate of Registration—retailer (began January 2023) | 253 |

| Adult-use cannabis Certificate of Registration—both distributor and retailer | 13 |

| Highway use tax (HUT) and automotive fuel carrier (AFC) | 126,939 |

| International Fuel Tax Agreement (IFTA) | 8,117 |

| Petroleum business tax | 1,968 |

| Alcohol beverage tax | 3,256 |

| Tobacco distributors and wholesalers | 305 |

| Cigarette agents and wholesalers | 155 |

| Cigarette chain stores | 1,183 |

Sales tax is New York’s largest transaction tax

In 2024, 570,214 businesses collected $19 billion in state sales tax. This is a 2.3% increase in collections from 2023.

| Calendar year | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|---|

| Sales and use tax collections (in millions) |

$13,485 | $14,119 | $14,799 | $13,450 | $15,867 | $17,490 | $18,574 | $19,000 |

| Number of sales tax vendors | 551,398 | 547,738 | 558,516 | 576,058 | 568,359 | 561,847 | 569,151 | 570,214 |

The 500 largest vendors reported more than 42% of total taxable sales in sales tax year 2024.

| Number of largest vendors | Percent of total taxable sales |

|---|---|

| 5 | 10% |

| 10 | 13% |

| 50 | 23% |

| 100 | 29% |

| 250 | 36% |

| 500 | 42% |

In 2023, most sales and use tax receipts were derived from retail trade and services industries.

| 2023 industry taxable sales* | Industry share of total taxable sales | Year-to-date change compared to 2022 |

|---|---|---|

| Retail trade | 42.4% | 0.8% |

| Services | 12.6% | 4.0% |

| Restaurants | 12.3% | 6.3% |

| Other** | 8.1% | 9.9% |

| Information | 6.0% | 1.7% |

| Wholesale trade | 6.0% | 0.9% |

| Manufacturing | 4.1% | 0.2% |

| Accommodation | 3.0% | 8.3% |

| Construction | 2.7% | 3.5% |

| Utilities | 2.7% | 2.4% |

| Total | 100.0% | 2.9% |

* Based on sales tax liability periods from March 2023 through February 2024. Liability data may not match collections data due to late payments, amended returns, adjustments, and so on.

** Includes unclassified vendors, agriculture, mining, transportation, education, finance, insurance, real estate, and government.

Taxable Sales Increase $54 billion since 2022

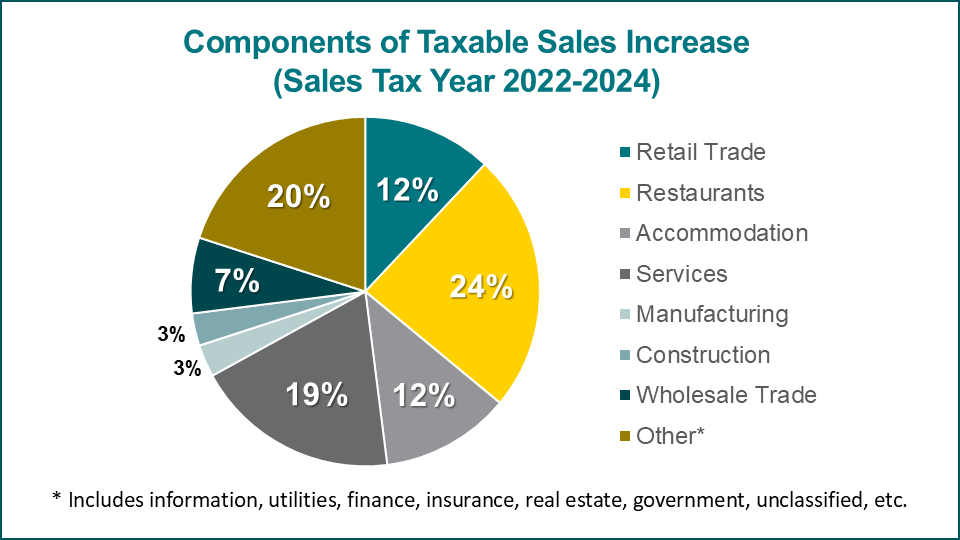

Reported sales subject to the state's sales tax increased by $54 billion from sales tax year 2021-22 to sales tax year 2023-24. Products and services generally purchased by individual consumers accounted for 67% of this increase (retail, restaurants, accommodation, services).

Components of taxable sales increase (sales tax year 2022-2024). For exact numbers, see data table.

Consumer savings from sales tax exemptions

New York State offers tax exemptions on food, clothing, residential energy, Internet charges, and cable television, as well as a motor fuel tax cap. These exemptions save consumers more than $5.7 billion on staples and necessities every year.

| Consumer item | Description | Annual consumer savings |

|---|---|---|

| Food | Food, food products, beverages, dietary foods, and health supplements sold for human consumption are exempt from tax | $2.3 billion |

| Residential energy | Wood used for residential heating, fuel oil, propane, natural gas, electricity and steam; and gas, electric, and steam services used for residential purposes are exempt from tax | $940 million |

| Clothing | Items of clothing and footwear costing less than $110 are exempt from tax | $900 million |

| Internet charges | Internet access service is exempt from tax | $790 million |

| Cable television | Cable television service is exempt from tax | $590 million |

| Motor fuel tax cap | Any portion of the motor fuel taxable receipt that exceeds $2 per gallon is exempt from tax | $230 million |

Cannabis Collections

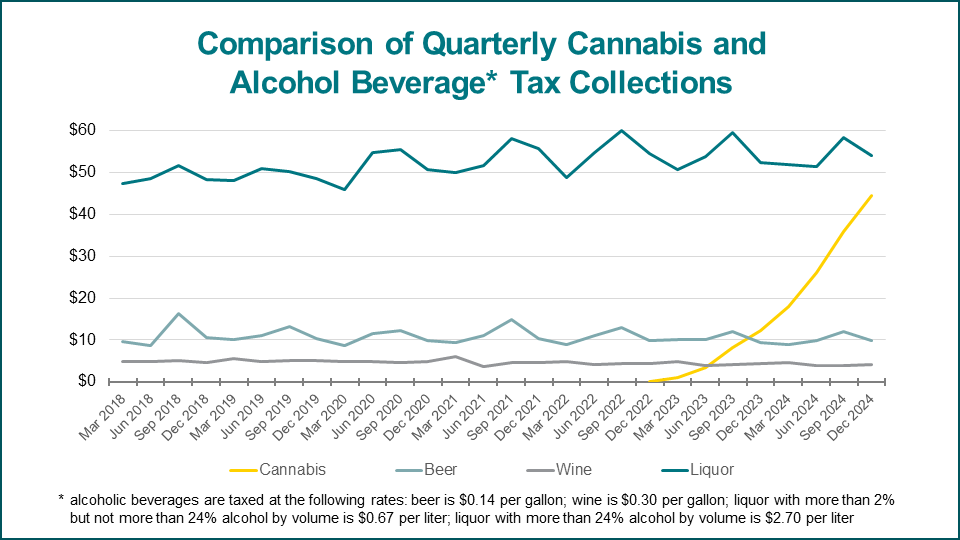

Quarterly cannabis collections surpassed quarterly wine collections in September 2023 and beer collections in December 2023 and continue to grow.

Comparison of quarterly cannabis and alcohol beverage tax collections. Cannabis, beer, wine and liquor from March 2018 to December 2024. For exact numbers, see data table.