Properly completing Form POA-1

Please refer to the examples, below, for guidance when completing, revoking, or withdrawing Form POA-1, Power of Attorney.

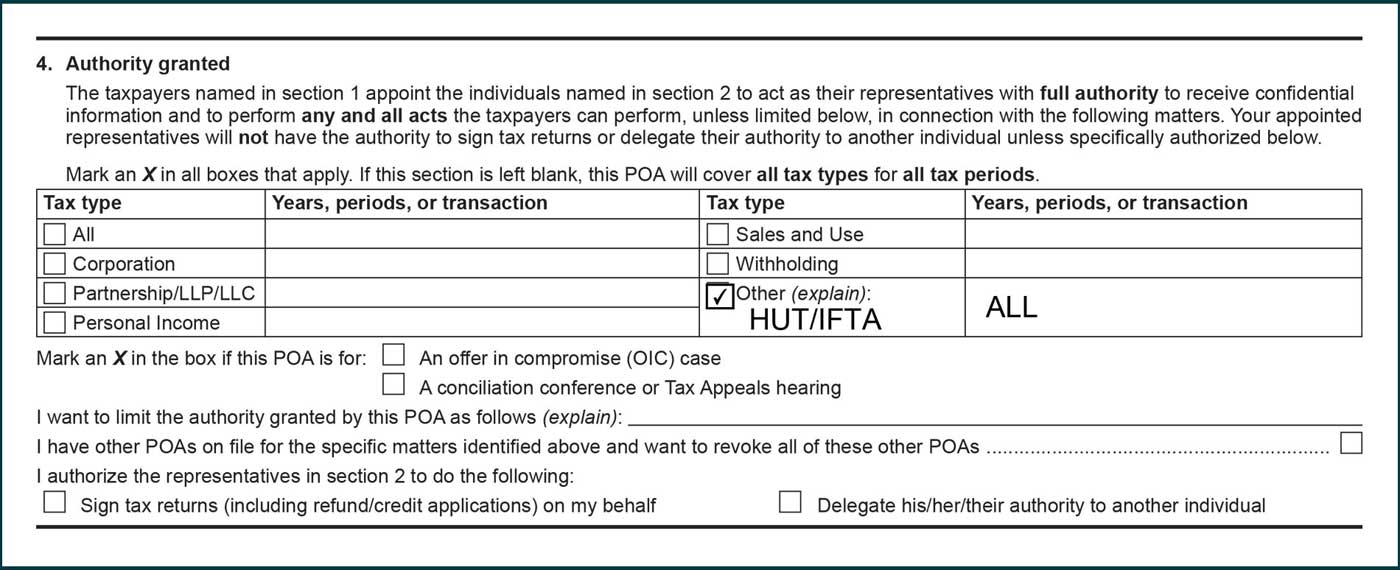

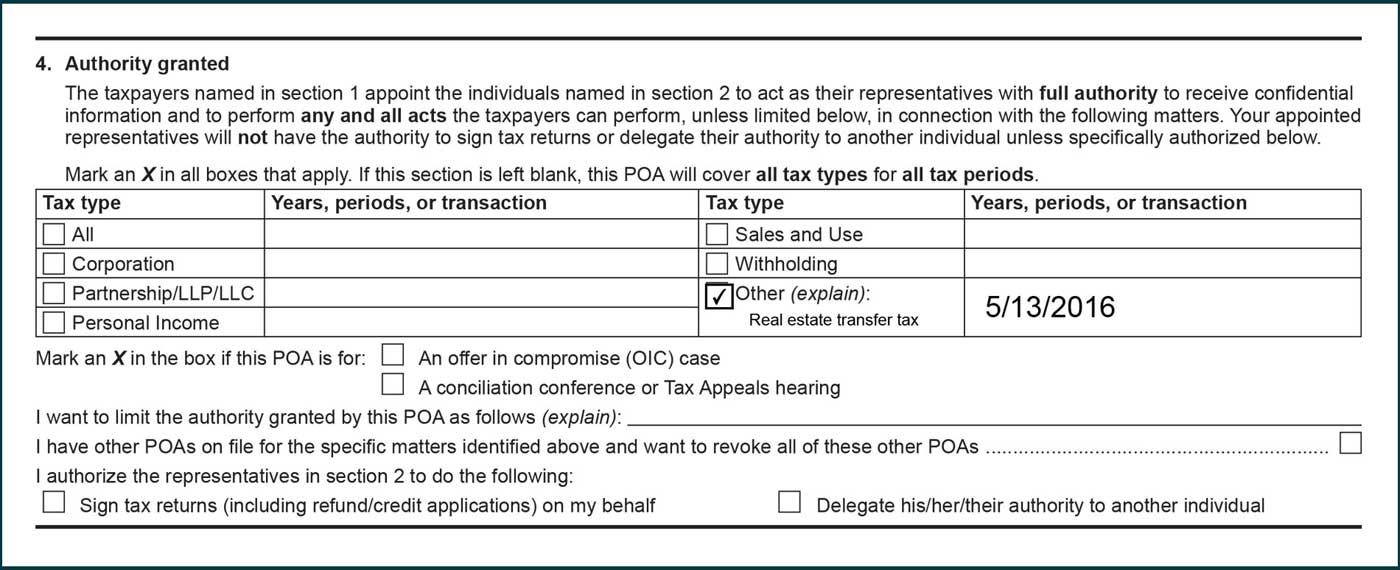

- When your tax type is not listed

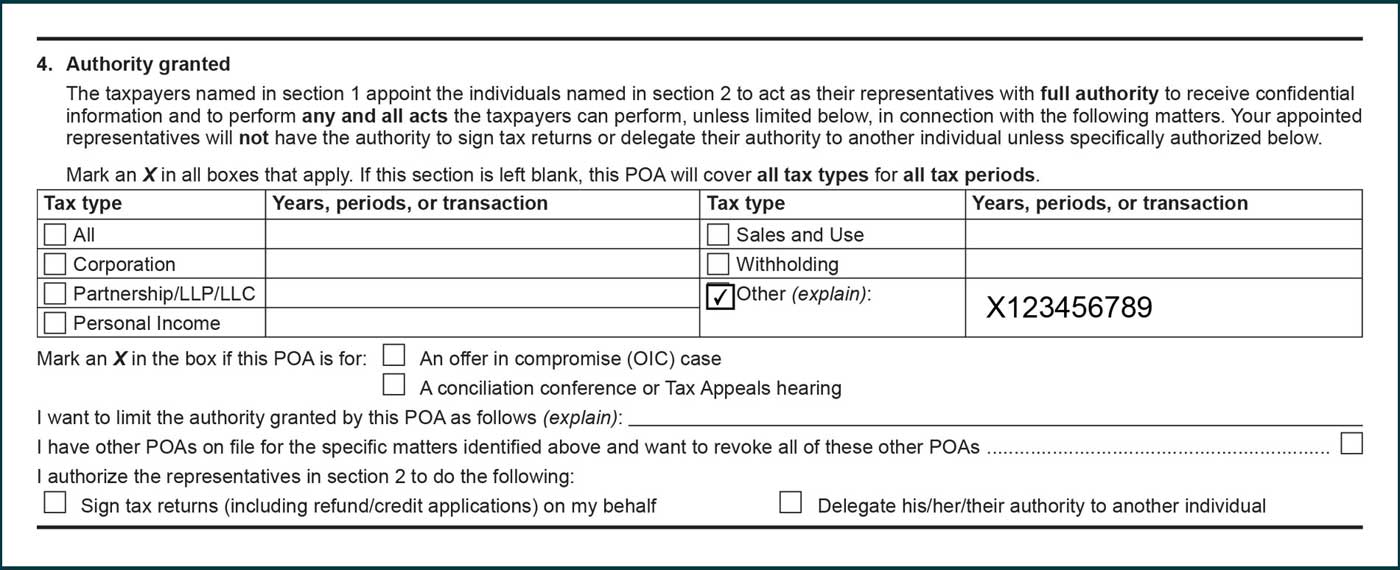

- When your Form POA-1 is for an audit case

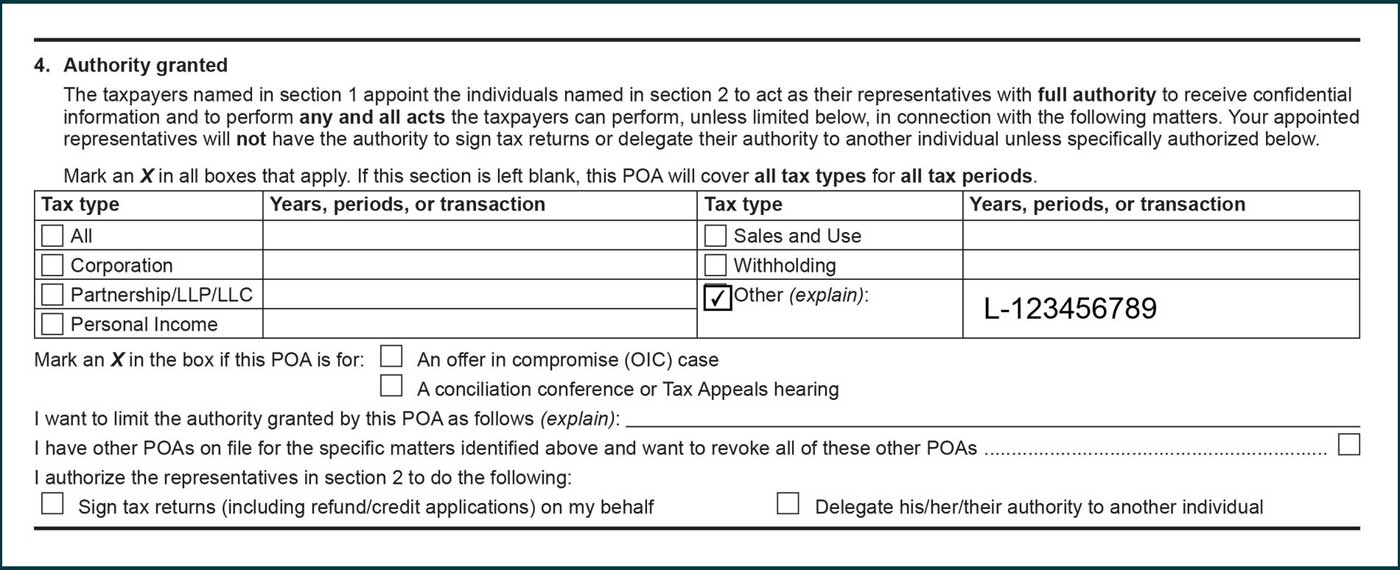

- When your Form POA-1 is for an assessment

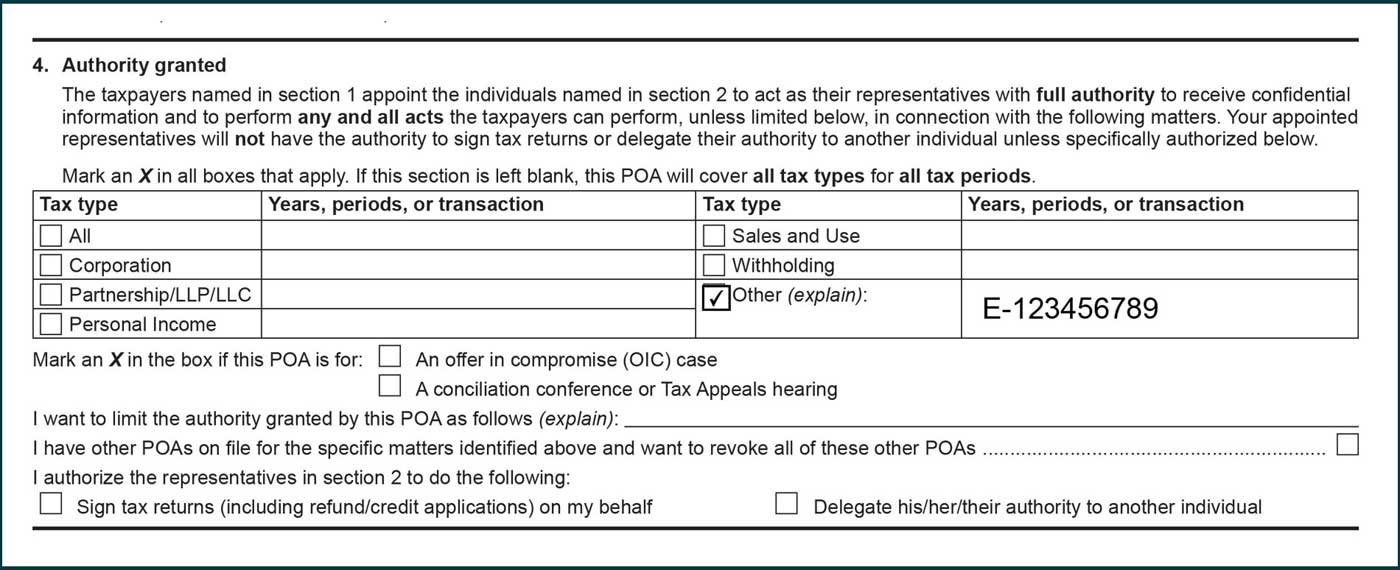

- When your Form POA-1 is for a collection case

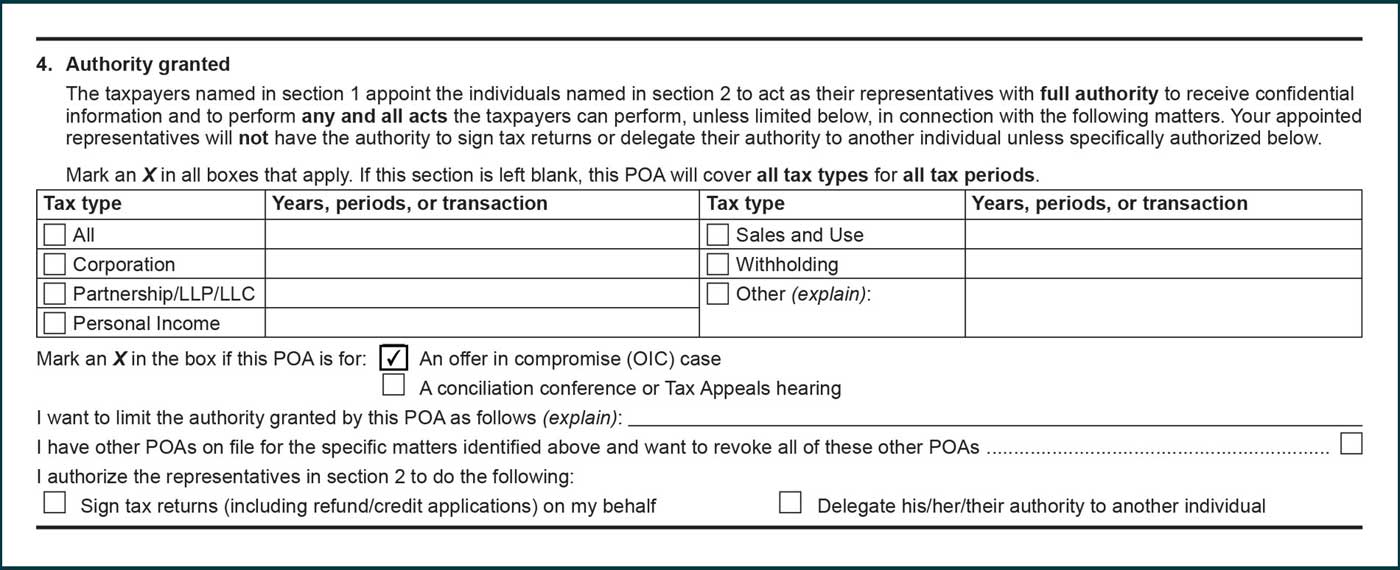

- When your Form POA-1 is for an offer in compromise

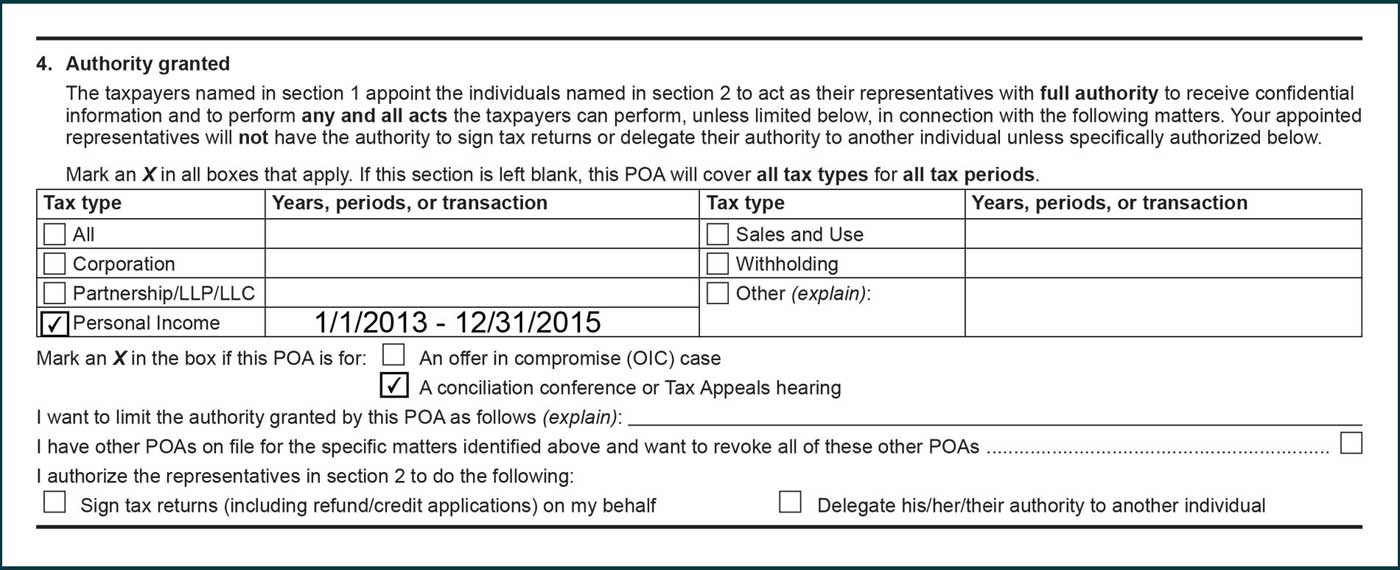

- When your Form POA-1 is for a conciliation conference or Tax Appeals hearing

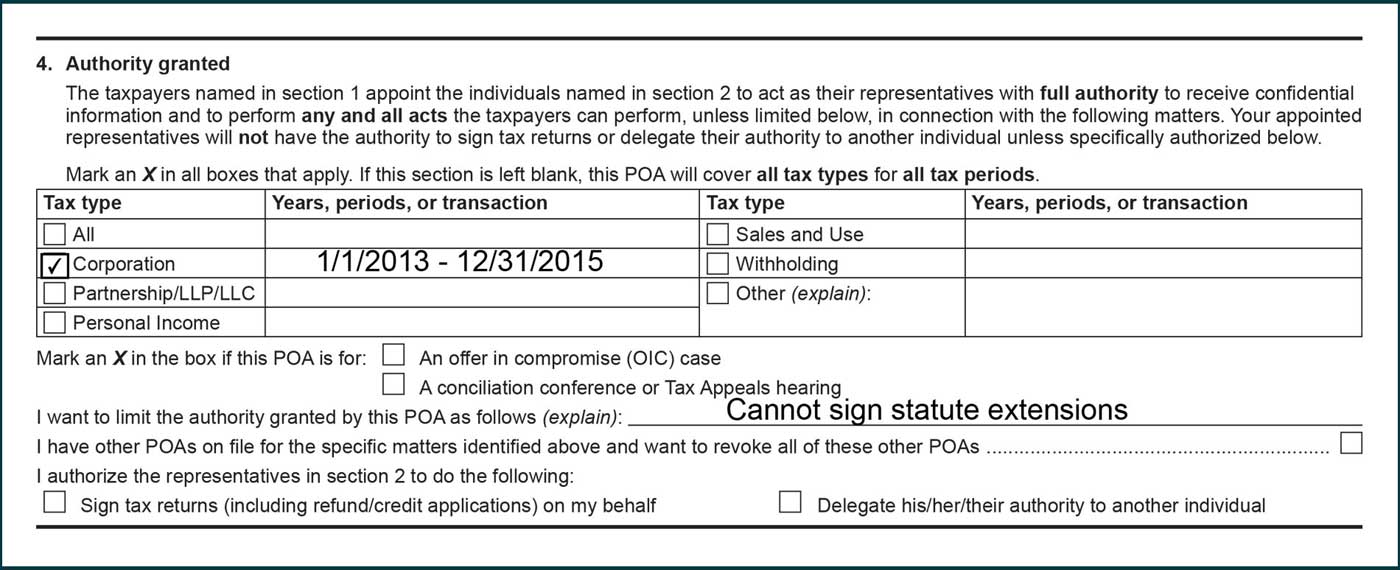

- When your Form POA-1 includes a limitation

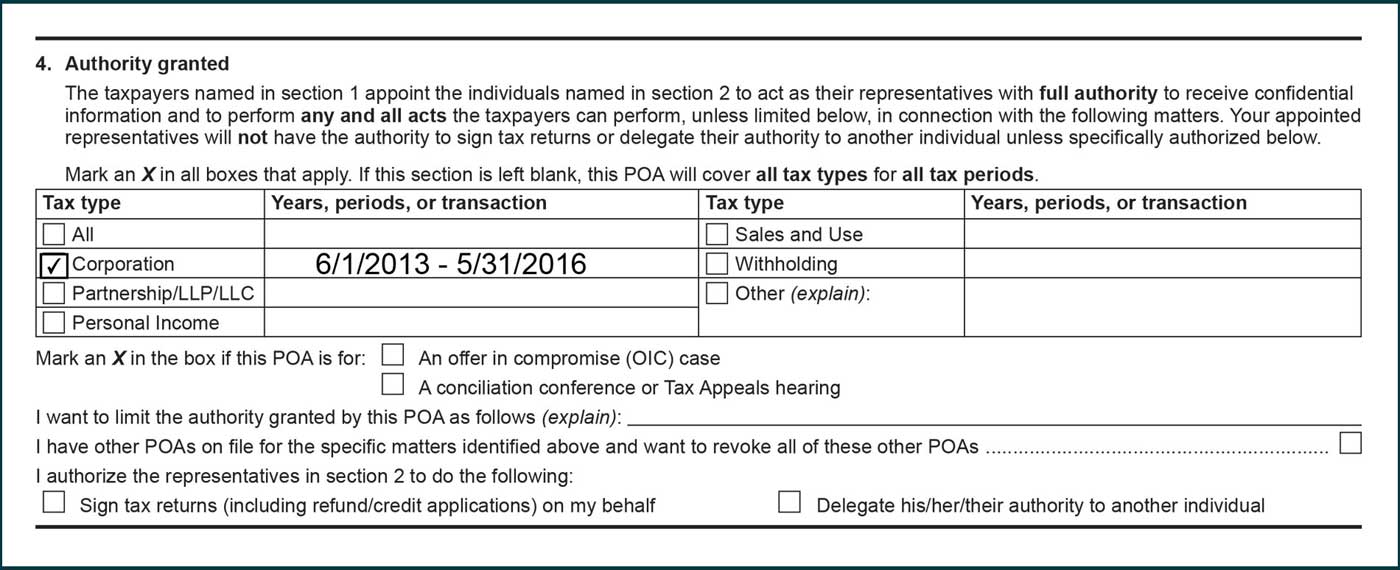

- When your Form POA-1 is only for a specific period

- When your Form POA-1 is only for a specific transaction

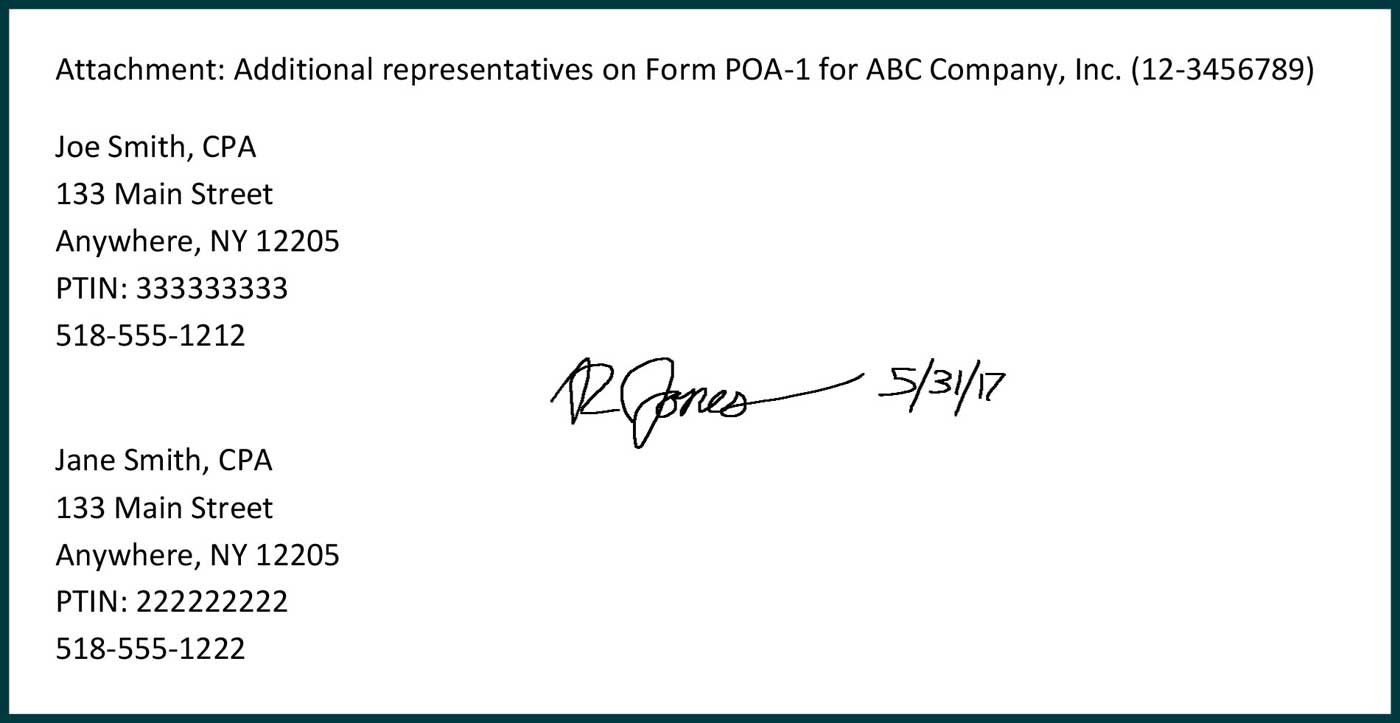

- When you need to attach additional documentation identifying representatives

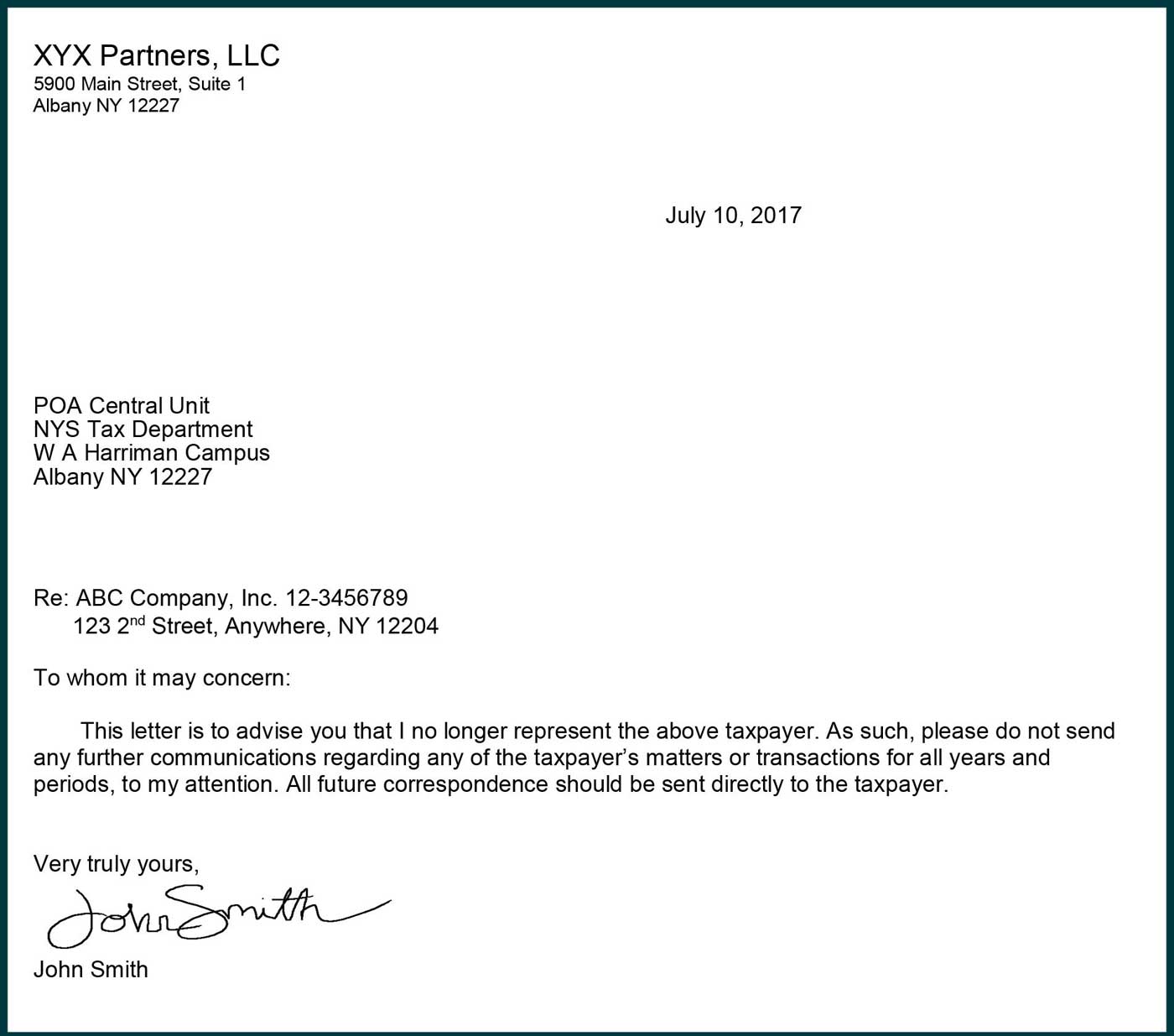

- When your representative needs to withdraw

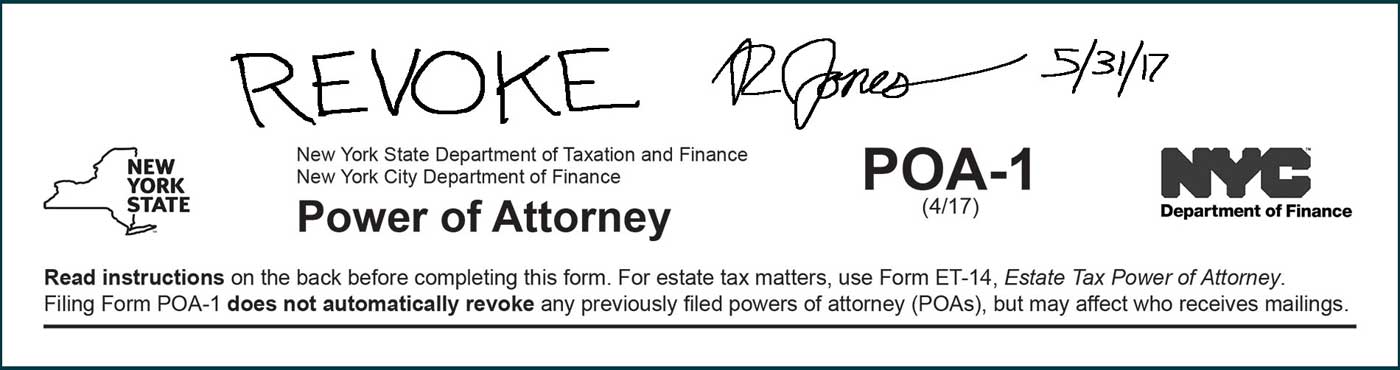

- When you need to revoke

- When you're ready to sign

Example: When your tax type is not listed

Example: When your Form POA-1 is for an audit case

Example: When your Form POA-1 is for an assessment

Example: When your Form POA-1 is for a collection case

Example: When your Form POA-1 is for an offer in compromise

Example: When your Form POA-1 is for a conciliation conference or Tax Appeals hearing

Example: When your Form POA-1 includes a limitation

Example: When your Form POA-1 is only for a specific period

Example: When your Form POA-1 is only for a specific transaction

Example: When you need to attach additional documentation identifying representatives

Example: When your representative needs to withdraw

Example: When you need to revoke

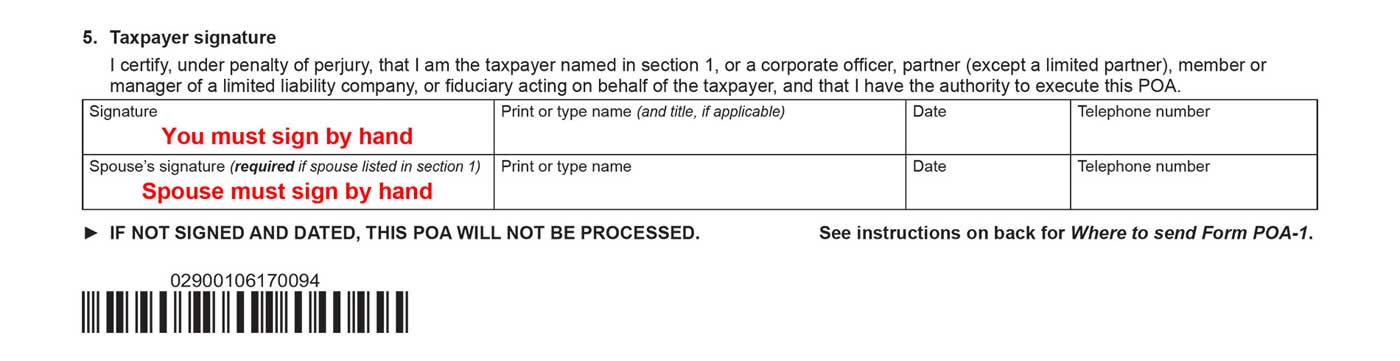

Example: When you're ready to sign

Resources

- Form POA-1: additional information

- Power of attorney and other authorizations

- Form POA-1, Power of Attorney

- Notice N-17-9, New Rules to Simplify and Expedite the Processing of Powers of Attorney

Updated: