Did you receive mail from us?

Pay with Quick Pay—no Online Services account required!

You or your business can use Quick Pay to make a payment toward a bill, notice, or installment payment agreement (IPA).

For step-by-step instructions, watch our Quick Pay demo for individuals or our Quick Pay demo for businesses.

Benefits include:

- data security—without needing to create an Online Services account

- no forgotten usernames or passwords—you don't need to log in if you already have an account

- no hidden fees—you'll pay directly from your bank account for free

Types of Mail we send

Request for Information letters

We may send you a Request for Information (Form DTF-948 or DTF-948-O) letter if we need documentation to support what you claimed on your personal income tax return.

If you receive one of these letters, or another personal income tax letter, respond as soon as you can so we can continue processing your return—and refund!

Letters to property owners

If you're a homeowner, we may send you a letter about STAR. Visit our STAR resource center to view a copy of the letter you received, and to learn what to do next.

Receive a different property letter? We also send letters to request additional information about property exemptions you may be entitled to. Follow the directions on your letter to learn more.

Bills and notices with an amount due

If you receive a bill or notice, you can find the amount due and due date in the upper-right corner.

You can pay your amount due on our website, either directly from your bank account for free or by credit or debit card for a fee. Watch our Demo: Making a bill payment for step-by-step instructions.

If you disagree with the amount shown or can't pay in full, you have options for resolving your bill or notice.

Other notices

Some notices explain an action we took or decision we made. These may later result in a bill.

Other notices request additional information about what you reported on a return for a tax other than personal income tax. These may include a letter from our audit department.

If you need to provide information, or want to challenge a Tax Department decision, you can respond online. We'll walk you through the process.

Informational letters

We may mail you information and resources to make it easier for you to file, pay, and perform other business with the Tax Department. These letters always point to our website, or include a QR code to scan and follow to our website.

We include much of this same information in our emails. Subscribe today to receive emails with tax tips, news, resources, and more. (If you have an Online Services account, you can additionally sign up to receive certain bills and notices electronically.)

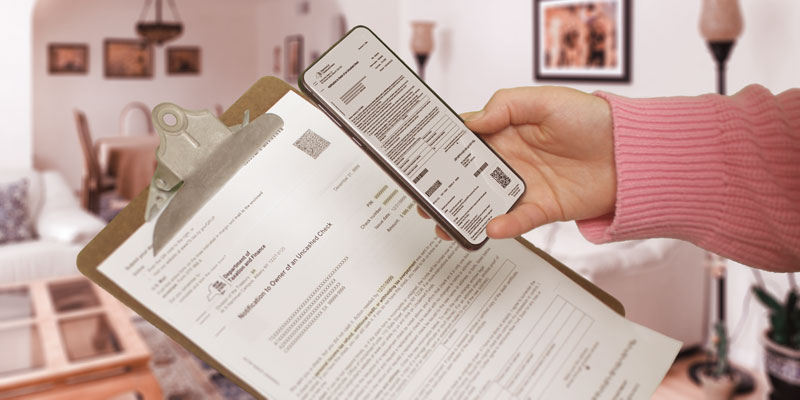

Lost, stolen, or uncashed check letters

Did you receive a letter asking you to complete Form DTF-32, DTF-33, DTF-36, TD-210.2, TD-210.3, or TD-210.7? To receive your new check sooner, use your mobile device to submit your form online!

- Scan the QR code on your letter.

- Snap a photo of your completed form.

- Submit your photo.

Benefits include:

- security, without the hassle of an account

- no printer or computer required

- instant confirmation we received your form

What we're mailing Now

Notice to pass-through entity tax (PTET) credit claimant: Your PTET entity must file its annual PTET return (Form AU-653)

If you received this notice, one or more entities associated with your PTET credit have not filed the required annual PTET return for the tax year listed on your notice. Contact your entities to confirm they filed. Entities must Web File the annual PTET return to report any tax due and allocate credit to partners, members, or shareholders.

If your entities do not file, we must disallow or adjust your claimed credit and send you a bill for tax, penalty, and interest due.

We need income information within 45 days from the date of this letter to confirm your eligibility for a STAR credit or exemption (Form RP-5300-WSC)

We’re sending letters to certain STAR recipients to confirm their income and determine which STAR benefit they’re entitled to.

If you received one of these letters, provide us with your income information online within 45 days of the date of the letter, either using our online Income Verification Worksheet (no account required) or through the Homeowner Benefit Portal in your Individual Online Services account.

If you need assistance, attend one of our in-person events where Tax Department staff will help you complete an income worksheet.

To learn more about your letter, see Respond to a STAR letter: RP-5300-WSC.

Letter about a possible refund (Form TR-210)

If you received a letter (Form TR-210), you may be entitled to a refund for the tax year stated on the letter. The refund might be from withholding amounts from a previous job, or an overpayment or carry-forward from a previous tax year.

To claim a refund, you must file an income tax return for the year stated on the letter.

For more information, go to Letter about a possible refund (Form TR-210).

Concerned about fraud?

Please report any suspicious contact, including by mail, you have with individuals claiming to be Tax Department or IRS employees. To learn how to recognize and report a scam, see Report a scam.