04/19/2021 Assessment Community Weekly

For immediate action: Review state-owned land lists

If your municipality has preliminary 2021 lists of taxable state land or taxable state conservation easements, please review them immediately if you have not already done so. You’ll find them in the Online Assessment Community. After you review all of the documents, certify the lists:

- in the Online Assessment Community,

- via email (orpts.statelandunit@tax.ny.gov), or

- by fax 518-435-8629.

If you have questions, email orpts.statelandunit@tax.ny.gov.

2021 STAR exemption amounts and maximum savings

We have certified and published the 2021 STAR exemption amounts statewide (except for school districts in Nassau County, which we will certify in May).

If you require a paper copy of the certificate, email orpts.star@tax.ny.gov.

2021 STAR exemption maximum savings are also available online.

Note for RPSV4 users: We will notify you in the upcoming days when the database update is available for STAR maximum savings amounts.

Enhanced STAR Good Cause: Q and As

For more information on the Good Cause program, see Late Enhanced STAR applications due to good cause.

Q. Why should ORPTS grant the Enhanced STAR exemption to a homeowner who didn’t submit their Enhanced STAR application by the taxable status date?

A. The intent of the Good Cause program is to grant the exemption to seniors who missed the deadline for a sufficient reason. RPTL 425(6)(a-2) authorizes the department to extend the filing deadline and grant the exemption if it is “satisfied that (i) good cause existed for the failure to file the application by the taxable status date, and that (ii) the applicant is otherwise entitled to the exemption.”

Q. I never received any paperwork from the homeowner, so how can I put the Enhanced STAR exemption on the roll?

A. The same section of the law also states, “the assessor shall thereupon be authorized and directed to correct the assessment roll accordingly, or, if another person has custody or control of the assessment roll, to direct that person to make the appropriate corrections.”

Q. How can I enroll a property in the IVP Tool without an application for the property?

A. If ORPTS grants the Enhanced STAR exemption as the result of a Good Cause application, it will enroll the property in the IVP directly, and the enrollment will be immediately visible in the IVP Tool. The assessor does not need to enter it into the tool.

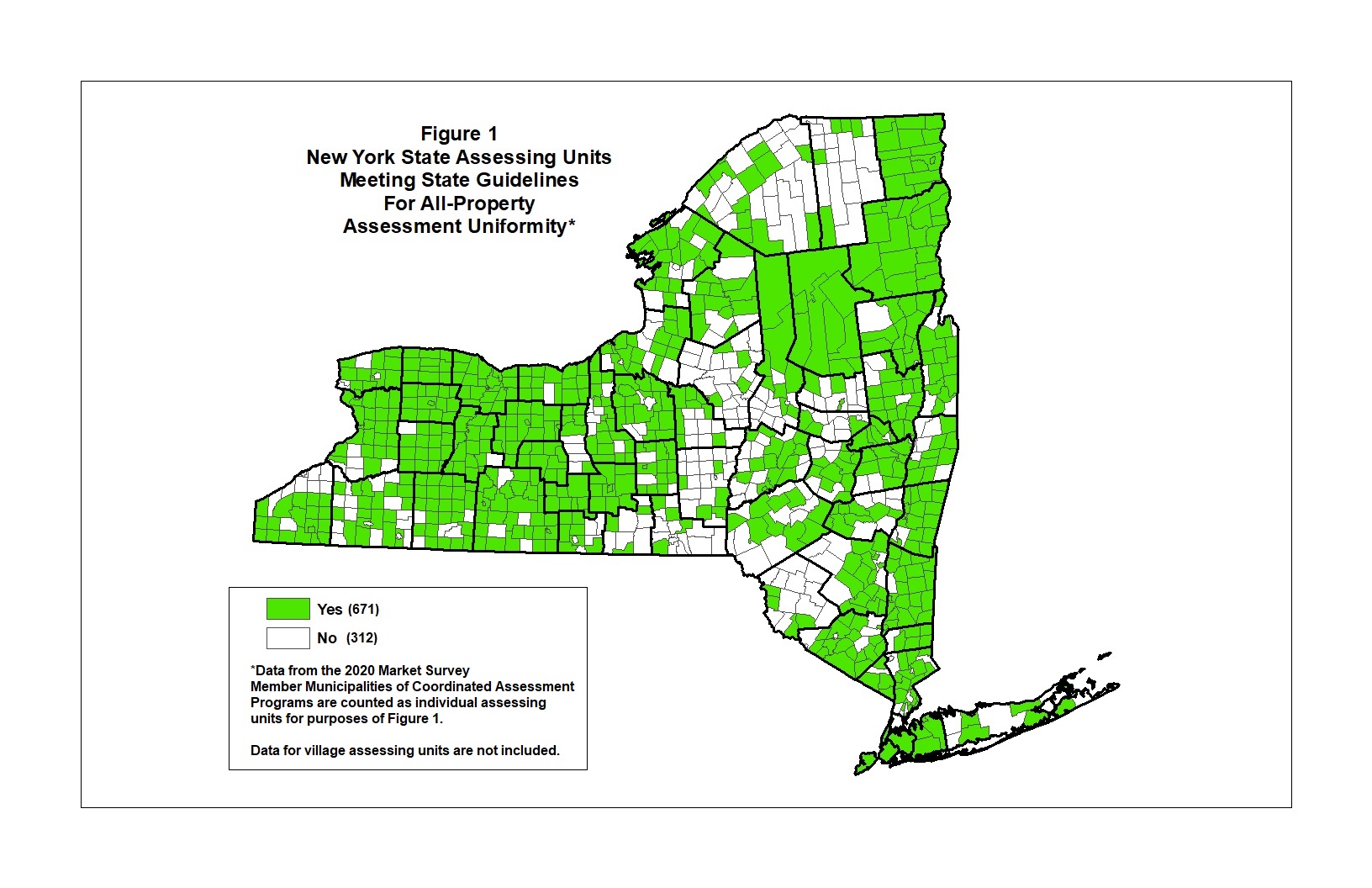

New report on assessment equity

Assessment Equity in New York: Results from the 2020 Market Value Survey is now available online.