08/02/2021 Assessment Community Weekly

Coming soon: STAR Credit Eligible Report

We expect to issue Report #8 this week for municipalities with school districts that issue tax bills around September 1. Watch your email for the announcement.

Preliminary discount rates and appraisal model for solar and wind projects

The 2021-2022 Enacted State Budget established a process for our department to develop a standard methodology for solar and wind energy systems with a nameplate capacity equal to or greater than one megawatt.

Preliminary discount rates and the preliminary appraisal model are now available on our website. See Appraisal methodology for solar and wind energy projects.

The deadline to provide comments is October 1, 2021.

We encourage interested parties to submit comments by email, but you can also submit comments by mail:

- Email: renewables.model.comments@tax.ny.gov

- Mail:

NYS TAX DEPARTMENT – ORPTS

ATTN: MICHAEL ST. GERMAIN

W.A. HARRIMAN CAMPUS

ALBANY, NY 12227-0801

Q and As about the new Online Assessment Community (OAC)

Thank you all for your patience as we transitioned to the new OAC. Here are a couple of questions that we received from you this week:

I work in multiple municipalities, and I previously had access to all of them in the OAC. Why am I only seeing one muni now?

The new menus are organized by user role. For instance, if you’re an assessor in one town, but a staff person in other towns, you’ll have to change roles in the menu. After you log in and agree to the security contract:

- select the hamburger menu in the upper-left of your screen,

- select Change role, and

- choose the role for the municipality you’d like to access.

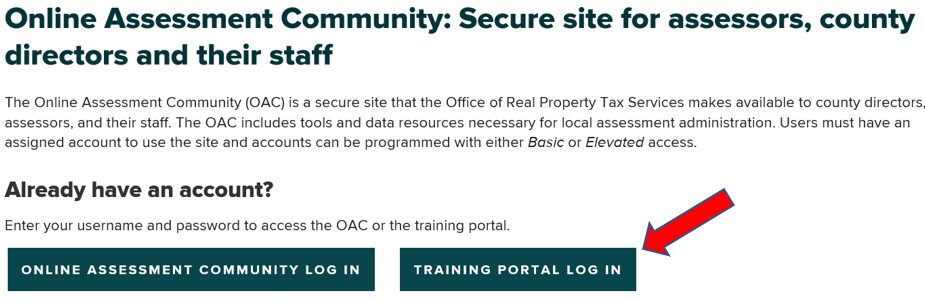

Why can’t I find a link for the Training Portal?

At the moment, the link for the Training Portal is not in the OAC. But you can easily access it from the Online Assessment Community landing page.

Still have questions or issues with the new OAC? Email the details to real.property@tax.ny.gov

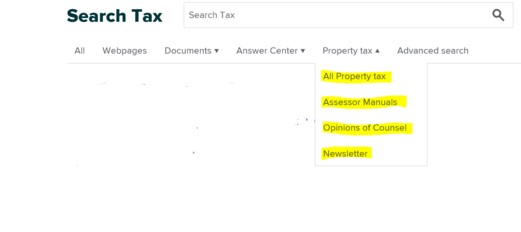

Focused searches temporarily not working

We’re big fans of our focused searches, and we hope you are too.

However, the focused searches are experiencing some technical challenges right now. We’ll let you know when they’re back up and ready for use.

Thank you for your patience.

Reminder: Review your sales reports

This is a great time to begin reviewing your sales reports in the Online Assessment Community. The deadline is August 31, but don’t delay. Your timely review is very important because we’ll use the sales data to begin the process of calculating 2021 equalization rates and RARs.

For more information, see Sales usability criteria.

On the arms-length report, there is a column which indicates whether the sale is COD/RAR usable. If you find a mistake or need to correct a sale, follow these instructions:\

- RPS users: within your RPS file, make the correction and then re-transmit it by going to Standard Reports > Sales > Sales Transmittal Report. Please email the RPS035 to ORPTS.saleint@tax.ny.gov. The ORPTS sales database and online sales reports will be updated with the corrections.

- If you submit paper reports, use Form RP-5217 ACR, Sale Correction Form. Email the completed forms to ORPTS.saleint@tax.ny.gov or mail them to:

NYS TAX DEPARTMENT – ORPTS

ATTN: DATA MANAGEMENT UNIT

W A HARRIMAN STATE CAMPUS – BLDG. 8A

ALBANY, NY 12227-0801

New judicial case

We’ve added Matter of Key Bank v Town of Amherst to new Judicial cases.