03/10/2025 Assessment Community Weekly

Final oil and gas unit of production values

The 2025 oil and gas unit of production values are final. There were no changes to the tentative values. For the details, see our Oil and Gas landing page.

2025 Tentative Special Franchise Values, Telecommunication Ceilings, and Q and As

We have sent the following:

- 2025 tentative telecommunication ceilings to all impacted municipalities, except for those waiting on final equalization rates

- 2025 tentative special franchise values to all municipalities, except for those waiting on tentative equalization rates

New for 2025: We streamlined the distribution of our notices for special franchise and telecommunication ceilings. County directors will now receive the email notifications at the same time as assessors, mayors, and county clerks.

Q. Can ORPTS tell me which school district my special franchise property is in?

A. Special franchise is reported only at a SWIS level. You can apportion it based on the percentage of the assessment roll that is in each school district or you can contact the company directly to identify more precisely which school districts are impacted in your municipality.

Q. What is the parcel identification number of my special franchise property?

A. The property in question is mass property, and mass property is treated as having no specific physical location for assessment purposes. The assessor may assign one or more parcel ID numbers for the special franchise property of each company as they see fit. The Tax Department has no role in the assignment of parcel ID numbers.

Reminder: Deadlines approaching to transmit or enter New IVP participants

In early April, we’ll issue the first round of STAR eligibility reports for municipalities with May 1 tentative roll dates. To ensure that we have complete data for new IVP participants for your municipality, please follow these deadlines:

- If you're transmitting the data to us for data entry, please do so by Friday, March 14. (For details see How to transmit IVP forms to the Tax Department.)

- If you're entering the IVP data directly into the IVP Tool, complete your entries by Monday, March 17.

If you submit or enter your data after the respective date, the properties might not appear on the April eligibility reports.

For complete instructions, see the IVP Tool User Guide.

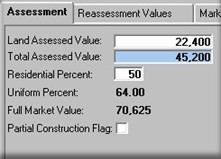

Using residential percent: How to apply a residential exemption to a mixed-use property

Residential property tax exemptions (such as 467, 459-c, and 458-a) are only available for the portion of a property that is used exclusively for residential purposes.

If a portion of the property is used for non-residential purposes, the exemption may only be granted to the portion of the property that is used exclusively for residential purposes.

To calculate a residential exemption for a mixed-use property, you should:

- determine the percentage of the assessment that is for the residential portion of the property, and if you’re an RPSV4 user

- enter that number on Assessment tab under Residential Percent.

This will ensure the exemption will only be applied to the assessed value of the residential portion.

For eligibility details of specific exemptions, review our Assessor Exemption Manual.

Stay up to date with news in our field

If you aren’t visiting Assessment and Property Tax News occasionally, you’re missing out on news regarding your profession that you may find interesting. Each afternoon, we survey the mediascape to find news related to property taxes, assessments, and other local government items. Most of the articles are from New York State media outlets, but we mix in the occasional national or other state item.

Drop by anytime to see the news for the past five days. We’ve also added a link in the footer of this weekly newsletter for your convenience.

If you come across an article of interest that we’ve missed, please send it to real.property@tax.ny.gov.

New Judicial case

We've added Airey v. State of New York to new Judicial cases.